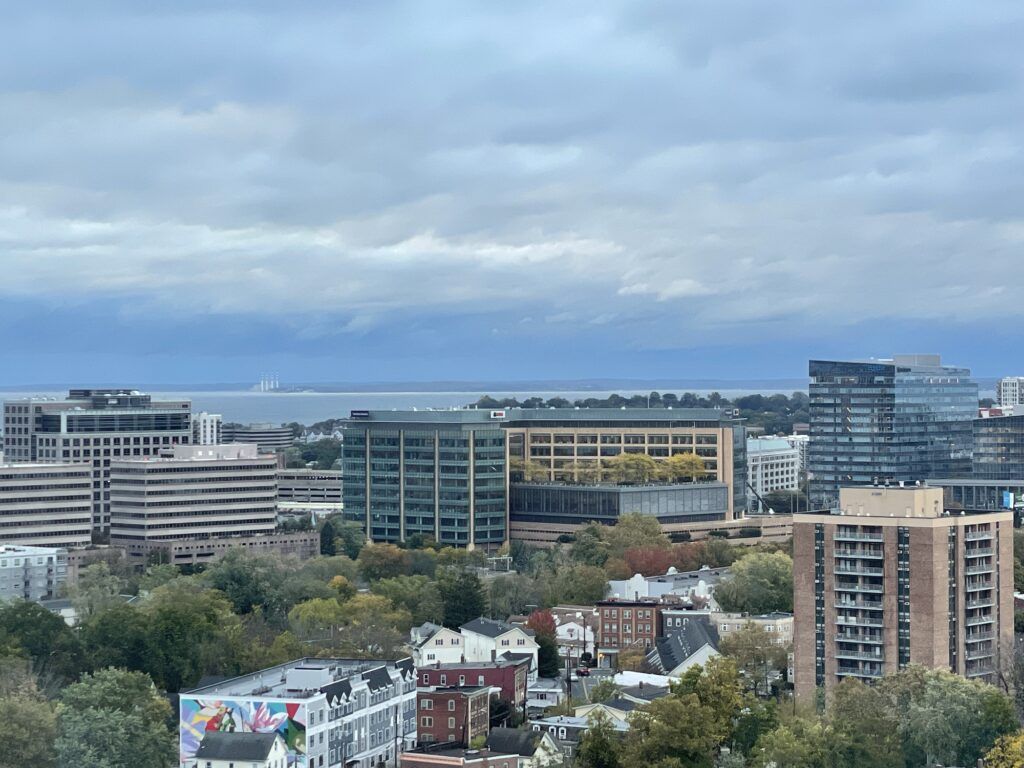

Stamford, Connecticut is a hidden gem in Fairfield County that offers a perfect blend of urban excitement and small-town charm. This vibrant city is the fourth largest in the state and serves as a hub for both business and leisure travelers. You’ll find a mix of modern skyscrapers and historic architecture, creating a unique skyline that reflects Stamford’s rich history and dynamic present.

Just 45 minutes from New York City, Stamford boasts excellent hotels to suit every budget. From the affordable Super 8 to the upscale Stamford Marriott, you’ll find comfortable accommodations for your stay. The city’s diverse neighborhoods, like the trendy downtown area and the scenic North Stamford, offer unique experiences for every type of traveler.

Discover hand-picked hotels and vacation homes tailored for every traveler. Skip booking fees and secure your dream stay today with real-time availability!

Browse Accommodations Now

How To Get To Stamford

Stamford is easy to reach by various transportation methods. You can fly into one of three nearby airports:

- JFK International Airport in New York

- Newark International Airport in New Jersey, near Jersey City Hotels

- Bradley International Airport in Connecticut

From these airports, you can take a shuttle, taxi, or rent a car to reach Stamford. For train lovers, Amtrak offers service to Stamford on the Northeast Corridor line. The trip from New York City takes about an hour. Metro-North Railroad provides frequent commuter train service from Grand Central Terminal in New York City. It’s a comfortable and scenic ride along the coast.

If you’re driving, Stamford is accessible via two major highways:

- I-95 (Connecticut Turnpike)

- Merritt Parkway (Route 15)

Both routes offer scenic views of Connecticut’s landscape. Be aware that traffic can be heavy during rush hours. Stamford’s downtown is walkable, but you might want to use local buses or taxis for longer trips within the city.

What To See In Stamford

Stamford offers a mix of urban charm and natural beauty. You’ll find plenty to explore in this vibrant city. Start your visit at Mill River Park, a green oasis in the heart of downtown. It’s perfect for a leisurely stroll or picnic.

For art lovers, the Stamford Museum & Nature Center is a must-see. It features art exhibits, a working farm, and hiking trails. Beach enthusiasts will enjoy Cove Island Park. It boasts sandy shores, picnic areas, and walking paths along Long Island Sound.

Nature buffs should head to Bartlett Arboretum and Gardens. You can wander through 93 acres of diverse plant collections and hiking trails. Downtown Stamford is great for shopping and dining. Check out Stamford Town Center for popular retailers and restaurants.

Movie enthusiasts will love the historic Avon Theatre Film Center. It shows a mix of independent and mainstream films in a charming setting. For a taste of local culture, visit the Stamford Downtown Farmers Market. It’s the perfect spot to sample fresh produce and artisanal goods.

Read our articles on the best things to do in Stamford, Connecticut and best restaurants in Stamford, Connecticut for even more ideas!

Where to Stay in Stamford

Read our article on hotels near Stamford, Connecticut for the best options for your stay. Here’s a short list of some options:

- Hilton Stamford Hotel & Executive Meeting Center

- The Stamford Hotel

- Hyatt Regency Greenwich

- La Quinta Inn & Suites by Wyndham Stamford / New York City

If you’re looking to stay in a vacation home, apartment, BnB, or VRBO in Stamford, Connecticut, we recommend you search on VRBO, Hotels.com, and Booking.com for up-to-date options.

History Of Stamford

Stamford’s roots trace back to 1640 when it was first settled by European colonists. Originally named Rippowam by Native Americans, the town was later renamed Stamford. In its early days, Stamford was a quiet farming community.

The 18th century saw the town grow into a bustling port, with trade and shipping becoming important economic drivers. The 19th century brought industrialization to Stamford. Factories and mills sprang up along the Mill River, transforming the local economy. This period also saw the arrival of the railroad, further boosting growth and commerce.

By the early 20th century, Stamford had become a popular summer resort for wealthy New Yorkers. Many grand estates were built during this time, some of which you can still visit today. Post-World War II, Stamford experienced rapid development. The city became a major corporate center, with many Fortune 500 companies setting up headquarters here.

Today, you’ll find a mix of historic charm and modern urban amenities in Stamford. From colonial-era buildings to sleek skyscrapers, the city’s architecture reflects its rich history and ongoing evolution.

Towns Near Stamford

Stamford is surrounded by charming towns that offer unique experiences. Greenwich, just a short drive away, is known for its upscale shopping and beautiful beaches. Norwalk, to the northeast, boasts a vibrant arts scene and the Maritime Aquarium. You’ll find great seafood restaurants along the water.

Head east to Bridgeport, Connecticut’s largest city. It’s home to the Beardsley Zoo and scenic Seaside Park. For a taste of big city life, New York City is less than an hour away by train. You can enjoy world-class museums, Broadway shows, and endless dining options.

Closer to home, don’t miss the nightlife in Stamford’s own downtown area. You’ll find cozy pubs and trendy bars perfect for unwinding after a day of sightseeing. Each nearby town offers its own flavor. Whether you’re looking for quiet beaches, cultural attractions, or bustling city life, you’ll find it all within easy reach of Stamford.

Find available hotels and vacation homes instantly. No fees, best rates guaranteed!

Check Availability Now